Disclaimer: The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers. Consult your financial adviser to understand whether any investment is suitable for your specific needs. I may, from time to time, have positions in the securities covered in the articles on this website. This is not a recommendation to buy or sell stocks.

Intro:

Fannie Mae (Federal National Mortgage Association) represents a fascinating special situation today which Bill Ackman called a “valuable perpetual option” on the company's exit from conservatorship. The preferred shares currently trade at 12-18% of face value, indicating return potential of up to 8x in most recapitalization scenarios. In this post I will summarize the business and the political background, then I will describe in detail the various scenarios to recapitalize the business as outlined by the Congressional Budget Office (CBO) and what it means for investors.

Business Background:

Fannie Mae is a government-sponsored enterprise (GSE) that helps finance a large share of home loans in the United States. They do so by purchasing mortgages from lenders and pooling the loans into mortgage-backed securities. The GSEs guarantee that investors who buy those securities will receive the principal and any interest that is due even if borrowers default on the underlying mortgages.

The business has changed dramatically from the dark days during the GFC of “under-regulated, under-governed, and under-capitalized” to “well-regulated, well-governed for all the risks and controls, and we’re at $4.3 Trillion in assets… and every day we are retaining our earnings to build capital” (4’50”, CEO Priscilla Almodovar, Breaking Barriers, October 2023). A recent August 2023 Dodd-Frank Act Stress Test indicated the GSEs would be profitable in a “severely adverse scenario”, but also notes that the accounting rules for establishing a valuation allowance on its deferred tax assets would result in a small loss.

Fannie Mae entered “conservatorship” in 2008 where it is overseen by the Federal Housing Finance Agency (FHFA) and is ~70% owned by the United States Treasury through its Senior Preferred Shares (SPS). The remaining ownership is publicly traded as Junior Preferred Shares (JPS) and common shares.

Political Background:

Politicians and regulators have had ongoing conversations regarding Fannie Mae and Freddy Mac's potential exit from conservatorship. Trump wrote a letter to Rand Paul on November 11, 2021 indicating his desire to fully privatize the GSEs and sell the government's stake for a “huge profit”. Democratic officials including David H. Stevens (former FHFA director under Obama) have also expressed support for “recap and release” and to transition to a utility model. Treasury Secretary Janet Yellen indicated at the February 6, 2024 House Financial Services Committee hearing that her staff “spends a great deal of time thinking about [monetizing the Treasury’s warrants in the GSEs]”, but she was not prepared to speak about it publicly. Other Democratic officials including James Parrot (senior advisor at the National Economic Council (NEC) under Obama) and Lael Brainard (current NEC director) have highlighted the affordable housing crisis without specifically mentioning “recap and release,” though some argue that monetizing these assets could play a meaningful role in addressing the crisis. Mark Calabria, former head of the FHFA, recently said there is about two to four years of work left to resolve the outstanding issues at Fannie and Freddie. As a result of the Collins vs. Yellen supreme court decision in 2021, Biden fired FHFA director Mark Calabria, a Trump-appointee and strong proponent for ending conservatorship. In 2022, his replacement Sandra Thomson said “We're preparing the enterprises to adjust to supervision in a way that they would be regulated outside of conservatorship.” Thomson noted that the role of the government outside of conservatorship would need to be clarified and that “investors will want answers… before they put a dollar in”.

In summary, an investment in Fannie Mae is viewed by many as a bet that Trump wins in November (a “Trump Trade”), but some argue that “recap and release” may also occur under a second Biden presidency. A slower and methodical transition may actually be preferable for both the public and investors in order to clarify the post-conservatorship arrangement and achieve a fully valued IPO. Bill Ackman wrote in his June 2023 letter, “We believe that it is simply a matter of when, not if, Fannie and Freddie will be released from conservatorship.”

Previously, the Biden administration implemented the “Net Worth Sweep” which required all cash flows above a threshold to be paid to the Treasury as dividends. In January 2021, Treasury Secretary Steven Mnuchin amended the Preferred Stock Purchase Agreement to replace the Net Worth Sweep with an increased liquidation preference “until the GSE has achieved its regulatory minimum capital”. Essentially, the government’s ownership stake increases along with the GSEs’ net worth, but the cash remains at the GSE. In 2023, a federal court ruled in Berkley vs. FHFA that the Net Worth Sweep is illegal for “arbitrarily or unreasonably” violating the reasonable expectations of holders of Fannie Mae junior preferred and common stock.

Recapitalization Plans

Below I will highlight major points from the CBO report regarding the mechanics of recapitalizing the GSEs.

Recapitalization would be evaluated based on the achievement of three goals:

Meeting capital requirements (as a percentage of assets).

Redeeming the outstanding senior and junior preferred shares.

Providing Treasury with some value for the warrants it received from the GSEs.

The CBO modeled various scenarios for recapitalization which can be simplified as follows:

Essentially, the cash available after an IPO would need to cover the regulatory capital requirements as well as payment to legacy preferred shareholders. In other words:

Cash on hand + proceeds from IPO > cash needed to meet capital requirements + payoff to senior and junior preferred shareholders.

Variables include:

Capital requirements

The valuation of an IPO as a result of:

Earnings and asset growth

Cost of equity/investor’s required return

Other factors: the degree of the government’s guarantee and any potential new legislation, restrictions on the fees or the types of mortgages they can guarantee, the continuation of benefits such as exemption from state and local taxes, increased competition, etc.)

Conclusion: In scenarios with low capital requirements and a high IPO valuation, the CBO models all three goals can be achieved. In scenarios with high capital requirements and a low IPO valuation, the GSEs would not meet any of these goals and could result in continued conservatorship or receivership.

Important Considerations:

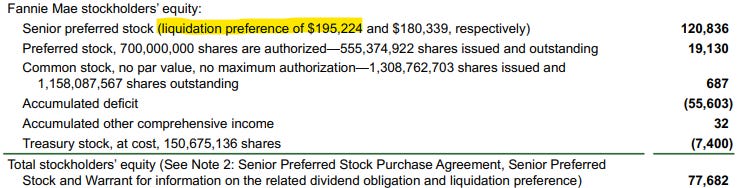

The government has a $195 billion “liquidation preference” as of 12/31/2023, which refers to the priority ranking for receiving dividend payments from the company or a share of the company’s assets if it is liquidated. The government’s liquidation preference increases each quarter by “an amount equal to the increase in our net worth, if any, during the immediately prior fiscal quarter” (2023 10-K, Footnote 12).

Despite the government’s ever-increasing liquidation preference, “it simply [is] not economically possible for the Treasury to recoup the par value of its preferred shares” (“Shelter from the Storm”, Mark Calabria, page 148) as the amount is capped by the value of the GSEs themselves even if the liquidation preference surpasses it.

2023 Form 10-K:

The government has warrants that give it the right (but not the obligation) to buy common stock equal to 79.9 percent of total outstanding shares–for a nominal amount. Those warrants expire on September 7, 2028.

This gives the government an incentive to maintain the value of the common shares so long as it doesn't require the government to take an even greater haircut on its liquidation preference.

The FHFA’s role as conservator “includes broad authority to change the preferred-stock agreements. As conservator or receiver, FHFA also has significant leeway to authorize the GSEs to modify their existing common and junior preferred shares and to issue new common shares” (CBO, page 5).

This increases risk of surprise changes to the agreements that could complicate the recapitalization process.

Scenarios:

Receivership:

Receivership would be the simplest and quickest process which Calabria describes as “cram down the liabilities to match the assets and then presto, you are good to go” (Calabria, Page 146).

Receivership would involve liquidating the GSEs’ assets or transferring them to other entities “including the Treasury and existing shareholders. Receivership could give FHFA more flexibility and control over the recapitalization process, particularly over addressing the claims of holders of existing junior preferred and common shares” (CBO, page 6). “The new corporation could then sell common stock and use the proceeds to capitalize itself and to reimburse shareholders in the old GSEs according to the priority of their claims. That priority order would require senior preferred stock to be redeemed before any junior preferred or common stock” (CBO, page 14).

“Receivership could eliminate the value of the warrants that permit the Treasury to buy common stock in the GSEs in the future for a nominal price” (CBO, page 6).

Conversion of Senior Preferred Shares:

The government could convert its Senior Preferred Shares to common shares (as occurred in the government’s bailout of AIG), junior preferred shares, or debt.

Converting the Senior Preferred Shares to common shares would effectively dilute the existing common shares to zero due to the influx of ~$200 billion of equity as compared to its current ~$1.5 billion market cap.

The Treasury could modify the agreements “to make its preferred shares redeemable–either at their face (par) value or for a different amount–as part of the sale of common stock” (CBO, page 11).

Calabria wrote, “short of a receivership, the cleanest solution would be to convert all the preferred shares, even those held by Treasury, into common equity. This would have the benefit of having the equity markets determine value instead of trying to work with a par value for the preferred shares that was far above their economic value. It would also allow the Treasury to share in any equity appreciation, as well as more easily exit its position… Common equity held by the government could be more easily sold into private hands than could preferred shares” (Calabria, page 148).

Calabria continued, “A conversion would also allow a more accurate reflection of Treasury’s claims without the political fallout of outright forgiveness. There had been some calls over the course of the conservatorship for Treasury to just forgive all or part of its claim. That was a nonstarter, politically, for Treasury. Moreover, Treasury claimed that it could not legally do so. A conversion of all preferred equity was one of the only ways to fix the companies' balance sheets in a manner acceptable to Treasury” (Calabria, page 148).

Issuance of new common shares:

Holders of Junior Preferred Shares have the right to “refuse to allow the GSEs to retire their claims on the GSEs’ assets and income at less than the face value of their shares in the lead-up to a sale of new common stock. That refusal would reduce the value of the new common shares, making recapitalization more difficult” due to the Junior Preferred Shares’ hierarchy over existing or new common shares” (CBO, page 13-14).

“If the Treasury wanted to raise capital through the sale of new common shares without resorting to receivership for the GSEs, the claims of junior preferred shareholders would have to be addressed” (CBO, page 14).

The CBO incorporates the judgment that “in scenarios in which the GSEs’ common-stock sale did not raise enough funds to redeem the full face value of both the senior preferred and junior preferred shares, the Treasury would take a reduction (known as a haircut) in the value of its senior preferred stake before requiring junior preferred shareholders to do so” (CBO, page 13). “CBO expects that redeeming the Treasury’s senior preferred shares or substantially modifying the preferred-stock purchase agreements or warrants would be a likely step in any recapitalization plan. In general, investors in the GSEs’ new common stock would want to have the claims of preferred shareholders settled, leaving owners of common shares in a position to receive the GSEs’ available profits after debtholders’ claims were paid” (CBO, page 18).

The government would likely have two choices involving an IPO, both of which should be good for junior preferred shareholders:

Offer junior preferred shareholders an attractive conversion rate which VIC user T0YPAJ182 estimated on 6/26/2023 would be at least 75% of face value.

Convert their senior preferred shares to common shares, and eventually pay dividends to both junior preferred and common shareholders.

Importantly, the junior preferred shareholders have real negotiating power in both the conversion and new common share issuance scenarios and must be satisfied in order for the government to maximize the value it receives from the equity market.

Summary of Outcomes:

IPO of common shares:

Junior Preferred Shares would either be redeemed or would participate in any future dividends.

Common Shares may be wiped out, depending on the IPO value and the “haircut” on the Treasury’s liquidation preference.

The Treasury may or may not receive value for their warrants, depending on the IPO value and the “haircut” on the Treasury’s liquidation preference.

Conversion of the Treasury’s Senior Preferred Shares:

Junior Preferred Shares would either be redeemed or would participate in any future dividends.

Common Shares would be wiped out due to dilution.

The Treasury would appear not to receive value for their warrants since the government would effectively own 100% of the common shares (additional shares would merely reduce the value per share).

Receivership:

Senior Preferred Shares would maintain their seniority. Junior Preferred and common shares would be at risk.

The Treasury would receive no value for their warrants.

Status quo:

Junior Preferred and common share prices remain stagnant indefinitely.

The Treasury’s warrants would expire in 2028.

Common Shares:

Bill Ackman wrote in his 2017 letter to shareholders: “We still prefer our investment in the common shares [over preferred shares] because the government and taxpayers’ interests, as owners of 79.9% of the common stock of both companies, are aligned with the interests of common shareholders.” Ackman also owns the preferred shares to hedge restructuring risk. Both common and preferred shares appear to be a small portion of his portfolio as they contributed a mere 0.8% to his returns during 2023.

Alec Mazo wrote an analysis that values the common shares between $15 and $43 per share in an IPO scenario (10-18x current prices), but still would be wiped out in a conversion scenario. Mazo wrote, “I am not certain how realistic the [conversion scenario] is because wiping out legacy commons while attempting to raise $100 Billion in new common and jr. preferred shares could present an insurmountable roadblock to the Government. A roadshow presentation would provide clarity on this question and investor feedback could be: “How can we be sure that the new commons are money good when the legacy commons are wiped out after the GSEs sent $300B in profits to the Treasury, well in excess of $191B injected by the Gov’t?” The Government would need to show good faith for the new common investors to step in.” Still, the risk of a zero seems too high given that a similar outcome can be achieved with less risk in the preferreds, and it seems prudent to expect the government to act in its best financial interest.

Issues of Junior Preferred Shares:

Wayne Olson describes in detail the varying issues of preferred shares which are listed in Note 12 of the 2023 10-K. Though “a rising tide lifts all boats”, the issues vary in terms of liquidity and the discount to face value. Below are the most attractive issues I found based on the combination of volume and discount to face value:

Series Q (FNMAI): 15 million shares outstanding, trading at ~14% of face value.

Series F (FNMAP): 14 million shares outstanding, trading at ~12% of face value. This issue is subject to a variable rate and therefore could yield a lower dividend rate if ever resumed. The 2023 10-K states “Variable dividend rate resets every two years at a per annum rate equal to the two-year Constant Maturity U.S. Treasury Rate (“CMT”) minus 0.16% with a cap of 11% per year”.

Series S (FNMAS): 280 million shares outstanding (by far the most liquid), trading at ~18% of face value.

Conclusion:

There are meaningful risks involved with receivership (a risk mitigated by the favorable Dodd-Frank Stress Test results) and the government's broad authority to change the stock agreements at will; however, the potential upside appears to be great enough to offer an attractive risk/reward. The significant discount to face value offers a margin of safety such that investors can expect a good return even with long delays in the timing of ending conservatorship or the discount to face value when redeemed (or alternately, when dividends are turned back on). For example, one could purchase preferred shares at 12% of face value to be redeemed for 50% of face value in 15 years (covering four presidential administrations), and earn a 10% IRR.

Calabria expressed disappointment when the Collins case removed the FHFA’s independence. “The plaintiffs may have brought forward the Collins case as an avenue for ending the conservatorships, but the reality is that the loss of the FHFA’s independence will make an end to the conservatorships less likely, as future presidents will be tempted to use Fannie and Freddie as a means toward their own political goals” (Calabria, page 209).

Bruce Berkowitz said at 1:08:00, “you would think that [preferred shareholders] would have a say on $34-36 billion of investments... The country is going down a very slippery slope… [the GSEs are now] just a piggy bank for social programs. How are you going to give up that kind of monthly income when you want to expand social services or you have an election coming up and you want to show the deficit is not as bad, or whatever you want to use tens of billions of dollars a year for.”

During the Collins hearing, Justice Breyer argued that the GSEs were “supposed to be private as well as having a public side, and then the government nationalized. That’s what they did. If you look at their giving the net worth to Treasury, it’s nationalizing the company… and they paid us nothing and our shares became worthless.”

With the checks and balances built into the United States legal system, my bet is that over the long-term, the preferred shareholders will receive at least some economic value from their ownership of the GSEs, with potential for massive near-term gains if they exit conservatorship sooner rather than later. Also, we may see meaningful share price appreciation as we approach the November elections and investors evaluate election probabilities. The risk posed by the United States government in this situation should be less than the risk posed by authoritarian countries like China, where I also own an investment. As Churchill said famously, “Americans will always do the right thing–after exhausting all the alternatives”... and one day Fannie Mae preferred shareholders will (hopefully) receive their dividend or redemption!

Legal and Disclaimer:

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). to the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

I read through some Fairholme’s last couple of reports and it appears he’s been divesting the preferred’s. He only owns a stake in one series and the share count at the end of 2023 is less than 2022. However his fund may be an interesting way to play this. I like St Joe’s too, but he’s selling those shares too,