1/1/2025 Portfolio Update and 2024 Review

My greatest contributors during 2024 were TSSI (up 1,200% from my average purchase price in May of 2024) and DESP (up 115% for the year). Fittingly, both of these ideas I researched during my travels to Omaha in 2023 and 2024, and I look forward to repeating the pilgrimage this year! My biggest potential mistakes involve position sizing, which may look deceptively straightforward in hindsight. I believe TSSI should have been a larger initial position, and BABA should have been smaller earlier in the year. For the speculative/early-stage PRRSF and RNGE I should have waited for cheaper prices before modestly buying more shares. To my credit, I (mostly) didn't sell TSSI as it grew, since the business outlook remains strong, and the valuation still appears reasonable if not cheap given the long-term opportunity (knock on wood). I will consider trimming later this year after it becomes a long-term capital gain for tax purposes.

Three out of four of my “deeper dives” this year (BABA, CPS, 038010/Jeil Technos) have been roughly flat or down since my publication, but I remain optimistic on all three. Fannie Mae preferreds have done incredibly well (up ~235%), but most of their outperformance is attributable to coin flip odds which was the U.S. presidential election. I reduced my position leading up to the election, which turned out to be the wrong choice financially although I'm still content with that decision.

Since I consolidated my stocks into one brokerage account on 2/8/2024, through 12/31/2024, my account grew 67.95% (money weighted return). This excludes a ~15% drop in Jeil Technos that is held outside my primary account and also a 25% special dividend from PPSI which I will receive in 2025 (the stock dropped significantly after it went ex-dividend). These two factors roughly offset each other.

Saquon Barkley recently said regarding his record setting season with the Philadelphia Eagles, “you can't be great without the greatness of others.” I'm grateful for all investors who have shared their ideas and research as well as company management teams and employees who have dedicated themselves to their jobs and businesses.

Below is a summary of my stock portfolio (which represents roughly 60% of my total investments) as of 1/1/2025:

TSS, Inc. (Ticker: TSSI) provides rack integration and other “end-to-end technology services for data center technology providers”. Dell is substantively their only customer. The Company experienced an incredible turnaround in 2024, may experience steady profits for a quarter or two before continuing their growth later in 2025 partly due to Elon Musk’s xAI expanding to 1 million GPUs for its latest supercomputer. Musk's role in the new adminstration may possibly lead to additional business from the U.S. government. The Company just recently moved to a new facility double the size. Management indicated that in 12-18 months, they expect to move beyond hyperscalers to include medium and large enterprises who will need modular data centers, including annual maintenance contracts with big margins. They also hope to expand their customer base to beyond just Dell. Challenges/risks include energy supply as well as Nvidia GPU shortages. For more detailed research, refer to Maj Soueidan, Mark Gomes, Breakout Investors, MultibaggerMonitor and ShareholdersUnite.

Midnight Sun Mining Corp. (Ticker: MMA.V) is a copper explorer in a copper-rich region in Zambia. The Company has renown and well-funded partners: First Quantum, whose partnership will provide short-term cash flows to Midnight Sun; and KoBold Metals, who will manage and fund the exploration of certain high potential copper targets. Eventually, they plan on selling their land to majors once the resources are defined.

Idaho Strategic Resources, Inc. (Ticker: IDR) is a gold miner in Idaho with three of the top nationally recognized rare earth elements projects and the largest known concentration of thorium resources in the United States. Critical minerals are in high demand due to long-term underinvestment and geopolitical tensions with China, who is currently the largest supplier to the United States, and the trade war threatens this supply chain. Thorium has potential to be a safer substitution for uranium as a nuclear fuel. Meanwhile, the gold business could double as soon as they complete construction on their paste backfill plant and add a nightshift. Longer-term, the outlook for gold prices appears positive and could provide a significant tailwind.

Alphamin Resources Corp. (Ticker: AFM.V) is the world’s largest and highest grade tin producer located in the Democratic Republic of Congo. Tin is an attractive investment for several reasons:

Increasing demand for electronics (50% use is for solder): phones, 5G, semiconductors, data centers, EVs, solar panels, batteries, IOT, etc.

Other varied uses for consumer products such as washing machines, air conditioners, plastics, cans, glass, toothpaste, as well as over 100 chemical applications.

Increasing demand due to modernization of emerging economies.

Steady if not decreasing supply. The largest tin producing countries include unreliable jurisdictions such as China, Myanmar (Burma), and Indonesia.

Price inelastic (tiny yet critical component of the final product).

Lack of institutional investment interest in the mining sector, despite AI tailwinds.

The miniaturization of electronics has reduced the need for solder even as electronics usage has increased over the past decade. This trend may be ending as sizes reach physical limitations.

Few publicly traded tin miners. Rick Rule described a similar phenomenon relating to silver bull markets as “shoving hoover dam through a garden hose”, which applies to tin as well.

Despite the political risk, there are no immediate threats to Alphamine’s mine. Militant groups in the DRC are >100km away and have little ability to sell tin concentrate on the black market as compared to other valuable metals such as gold or coltan. Alphamin also has support from the DRC military as well as their own security forces. More immediate and recurring challenges include transporting the tin to ports across sub-par road infrastructure with delays due to severe weather. Christopher Ecclestone of Hallgarten & Co. describes his experience visiting the mine in detail.

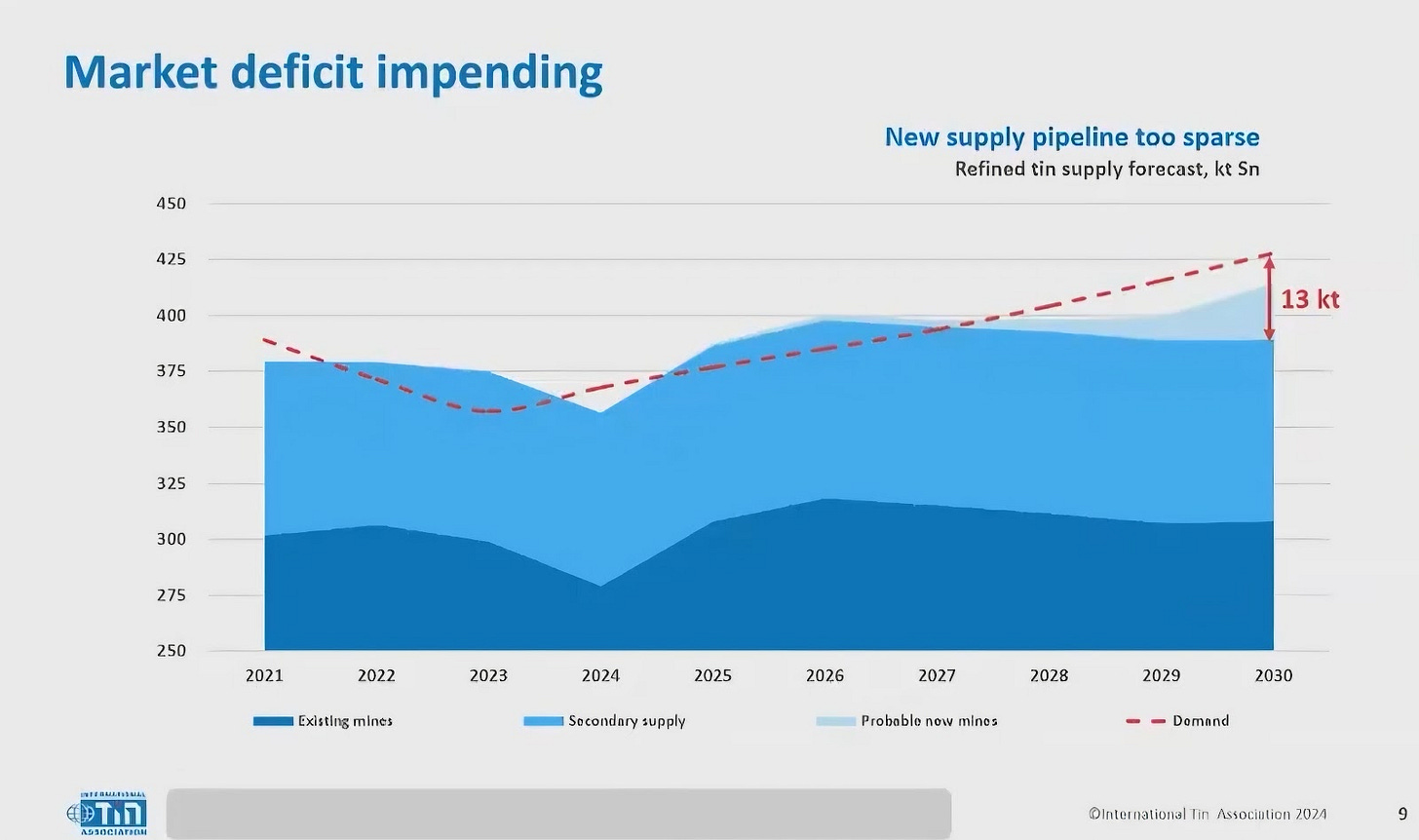

As presented at the recent “Investing in Tin Seminar”, the chart below indicates a supply deficit that could begin accelerating rapidly in 2027.

Almonty Industries, Inc. (Ticker: AII.TO) is the world’s largest tungsten producer, and will soon supply roughly 40% of the world’s non-China sourced tungsten once its Sangdong mine in South Korea achieves its production target in 2027. Similar to tin, tungsten is used in electronics as well as military equipment, and recent escalations to the trade war with China further increase the importance of a western source for tungsten. Almonty’s Portugal mine, Panasqueira, has been operating since 1886, and according to CEO Lewis Black, mining tungsten requires highly specialized knowledge. The Sangdong mine is expected to produce for 90 years, has high grade, and is supported by the South Korean government. Almonty received debt financing on favorable terms from the German state-owned KfW IPEX-Bank, and also secured a 15 year offtake agreement with a USD$235/MTU (metric ton units) floor price and no upside cap. Here is a good background on the market for tungsten.

Burford Capital (Ticker: BUR) is progressing on collecting from Argentina for the YPF case. As explained on the Q3 2024 earnings call, Argentina submitted appeals to the Second Circuit Court of Appeals which are now awaiting oral argument before a 3-judge panel which Burford expects to occur early this year. This panel’s decision is expected “some months” after they hear the oral arguments. Burford expects little changes to this same court’s previous decision in favor of YPF/against Argentina. After this decision, Argentina may request an additional appeal from the U.S. Supreme Court which is granted less than 5% of the time. If this appeal is granted, that would add between 12 and 18 months to the process. Meanwhile, the trial court judgement is enforceable even though it is on appeal. CEO Christopher Bogart said, “the goal of enforcement campaigns is to apply pressure and create friction so that a rational negotiation can occur… Argentina is rebuilding its economy and resuming its place on the world stage. And to do that, it needs to rejoin the capital markets and participate in the global economy. Having a large unsatisfied U.S. court judgment and ongoing enforcement proceedings around the world that also sweep in third parties is sand in the gears for that normalization process. And it should, in our view, ultimately lead to a commercial resolution. Put simply, we are a nagging problem that Argentina needs to solve.”

My hopeful expectation is for roughly a 200% return over the next few years. Burford’s current market cap is ~$3 billion, and they could receive ~$3 billion (50% of their portion of the total judgment) from Argentina; meanwhile, the rest of the business could continue to grow at roughly 15-20% per year while we wait.

Despegar.com, Corp. (Ticker: DESP) is soon to be acquired by Prosus for $19.5 per share. Although I’m pleased with my return of roughly 250% in under 2 years, this price is likely still a bargain for Prosus. I already sold more than half of my shares, and I plan on liquidating shortly.

DIRTT Environmental Solutions Ltd. (Ticker: DRT.TO) builds pre-fabricated “dynamic spaces that adapt and evolve in response to changing needs.” Greater flexibility in construction can save clients money, allowing for quicker construction timeframes with accurate budget forecasts and less manual labor currently in short supply. They also license their construction planning software to larger companies such as Armstrong World. Dirtt has sold their solutions to 30% of Fortune 500 companies. The largest shareholder is hedge fund 22NW which began acquiring shares in 2020, with a potential cost basis around CAD$2.5-3.0 per share as compared to today’s CAD$1.01. Two hedge funds went activist in 2022, replaced the board, and hired CEO Ben Urban to lead a successful turnaround. The Company is inflecting to profitability and has the capacity to double sales volume with minimal capex. The Company is just beginning to share their story with investors, and appears to be a successful turnaround that the market hasn’t yet noticed.

Globex Mining Enterprises, Inc. (Ticker: GMX.TO) is a diversified North American portfolio of mid-stage exploration, development and royalty properties containing precious metals, base metals, specialty metals and minerals, and industrial minerals and compounds.

CEO Jack Stoch describes the business as a “mineral property bank”, essentially buying mining assets cheaply when they’re out of favor, and eventually partnering with producers to mine the land in exchange for a royalty, thereby avoiding the risks of unpredictable capex. The following quote from the NoNameStocks blog caught my attention: "in late 2007 the company was approached with a buyout offer at $7 CAD = $6 USD at the time. The deal fell through but I mention it just to add a piece to the puzzle of what this thing is worth. Given the share count that's $108m USD when Globex had 76 properties and 6 royalties, whereas now Globex has 252 properties and 106 royalties available to you for $20m USD." Notably, the Company chooses to value most of their properties at zero on the balance sheet, rather than pay auditors for 252 appraisals. Many of these projects could end up worthless, but their Ironwood and Mont Sorcier projects in particular are progressing well and could create significant value. If commodity prices rise, then perhaps more of these projects could become economical.

Joint Stock Company Kaspi.kz (Ticker: KSPI) created and operates a “super app” in Kazakhstan that offers users a single platform to make payments, shop online, borrow money from a bank, make travel arrangements, renew a drivers license, order groceries, and more. The closest comparison is WeChat in China. Kaspi is asset light with high ROIC, net cash, a near 70% payout ratio including a 7% dividend and occasional share repurchases, and annual net income growth over 40% for each of the past 4 years. Kaspi continues to innovate, finding new services to offer on their app. 70% of the country already uses the app, leading to an audience ready to try new offerings. Kaspi recently acquired Hepsiburada, the number two e-commerce company in Turkey behind Alibaba’s Trendyol, and plans to continue growing internationally. I first heard about Kaspi from Pavel Begun last year in June. Mr. Begun explained that Kaspi not only displaced Mastercard and Visa, but also replaced Alibaba as the number one e-commerce company in Kazakhstan in just three years.

Vincent Lo of Kathmandu Capital explained on Edwin Dorsey's “IdeaBrunch” newsletter: “Kazakhstan has also emerged as a key trade corridor between Asia and Europe, catalyzed by regional conflicts. As Europe diversifies its natural resource dependencies away from Russia for national security reasons, and Asian countries seek new avenues for trade due to Russian sanctions, leading to our view that Kazakhstan's strategic importance is poised to grow significantly, driving foreign interest and investment.”

Currency depreciation is a major risk, with some analysts expecting currency depreciation against the dollar in the range of 5-15%, which would reduce Kaspi’s earnings in USD. With the ongoing change in the global monetary system shifting away from the US dollar as a reserve currency, I wonder if the currency depreciation may be less than feared. Additionally, Kazakhstan’s economy is heavily dependent on oil and uranium, and is therefore heavily influenced by those commodity prices. Culper Research recently published a short report which raises some unique risks involved with operating in frontier markets.

For a P/E of ~10, Kaspi appears cheap for a fast-growing capital efficient business dominant in Kazakhstan with continued growth potential within Kazakhstan and internationally.

Prospect Ridge Resources Corp. (Ticker: PRRSF) is an exploration company in British Columbia, Canada, with drilling targets containing gold, silver, copper, lead, and zinc. High grade surface sample results, and an experienced management team makes this an appealing opportunity, though it remains highly volatile and speculative with potentially massive upside. Additionally, the Company says they have a good quality shareholder base, as well as good relationships with locals who help them manage the bureaucracies involved with permitting. Despite recent drilling results showing relatively low grade, management noted the positives including great continuity of the mineralization which fulfill the potential to create significant volume.

The following interview gives insights into their approach:

CEO Michael Iverson: [We need to do] as much exploration and drilling as we can, understand the property fully before someone comes knocking, because I do believe that there is a lot more than just Copper Ridge… There's much more happening here that needs to be investigated, and what I don’t want to see happen is us selling something prematurely and leaving tens of millions of dollars on the table that should be going to the shareholders. And so we need to understand this property as much as we can before we get to that stage. So that might take 3, 4 or 5 years… I don’t want to leave something behind.

One thing you notice in the golden triangle is you don’t see many juniors having mines. Big companies are moving in right away... These guys are up there looking [to acquire land]… With us controlling “x” amount of shares, someone can’t come against us and do a hostile takeover, and that’s one of the things we set up from the very beginning. We have some very strong shareholders that have been with us a long time.”

Legal and Disclaimer:

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN.

The information contained on this website has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author, the author’s affiliates, and clients of the author’s affiliates may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). to the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.